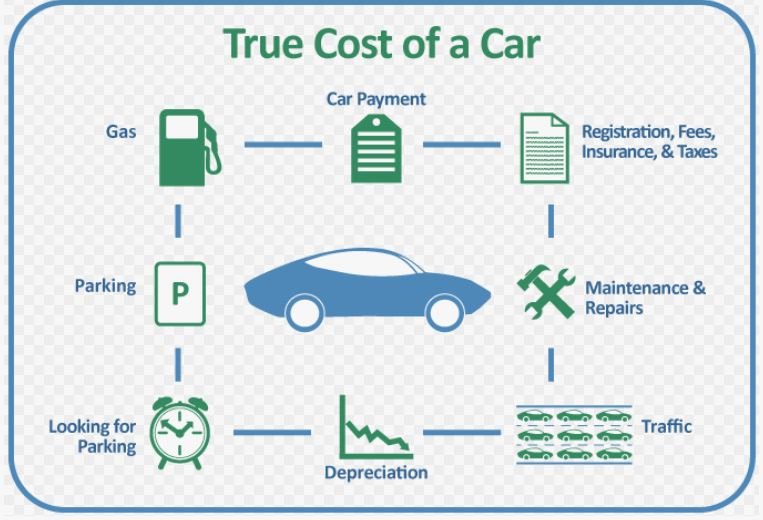

Buying a car involves far more than just the sticker price, with additional costs like maintenance, insurance, fuel, and depreciation often adding up. To understand the true financial impact of owning a car, it’s essential to consider all expenses involved. In this article, we will break down the full cost of car ownership, exploring how factors like location and car type influence costs and why knowing about services like “car wrecker Adelaide” can be helpful when it’s time to retire or sell your vehicle.

Initial Purchase Price and Down Payments

When purchasing a vehicle, the sticker price is often the most prominent figure, but it’s only part of the initial costs. Many buyers finance their vehicle, which means putting down a down payment and taking out a loan. The amount of this down payment can significantly affect monthly payments.

Financing terms, interest rates, and the total loan amount contribute to the total cost. Typically, a down payment of at least 20% is advised to reduce interest payments. For instance, when comparing two similarly priced vehicles, one with a lower interest rate or a higher down payment can be much more affordable in the long run. Additionally, if the car is still in good shape at the end of its lifespan, it may be worth contacting a “top car wrecker in Adelaide” for valuation.

Understanding Loan Interest and Financing Fees

The cost of financing can also add significantly to the overall expense of car ownership. A higher interest rate on a car loan can result in a higher total price. Monthly payments are based on the principal amount (the original loan) and the interest, which can vary depending on your credit score, loan term, and the loan type.

Understanding the amortization of the loan is essential, as many buyers often underestimate how interest accumulates. Choosing shorter loan terms can help reduce the total interest paid over time, although this may mean higher monthly payments. By paying attention to interest and fees, car buyers can more accurately estimate the total financing cost. And in cases where vehicles are no longer functional, selling the car to a “car wrecker Adelaide” is one way to recoup some value.

Depreciation: The Hidden Cost

Depreciation is one of the largest expenses associated with car ownership. Unlike other costs that involve spending cash directly, depreciation affects your car’s resale value, making it worth less each year. Typically, a new car loses around 20-30% of its value within the first year and continues to depreciate over time.

If you plan on selling or trading in your vehicle after a few years, depreciation is critical to keep in mind. Researching cars with low depreciation rates can help you retain more value in the long run. Some owners may also choose to sell their vehicle to a “car wrecker Adelaide” at the end of its life to maximize any remaining value in parts and materials.

Insurance: Comprehensive and Liability

Insurance is another essential aspect of car ownership. The type and amount of insurance required depend on several factors, including the car’s make and model, the driver’s history, and local laws. Premiums can vary greatly based on these factors, so it’s crucial to compare quotes and find a policy that suits your needs.

Comprehensive insurance covers damage from accidents, theft, or other incidents, while liability insurance only covers damages to other vehicles or property. Comprehensive coverage is usually more expensive but can be beneficial in the event of an accident or theft. If your vehicle is older or valued less, a lower-tier insurance policy may make more financial sense. Knowing options like “car wrecker Adelaide” can also help if your car is totaled or reaches the end of its useful life.

Fuel Costs and Efficiency

Fuel expenses fluctuate widely based on vehicle type, driving habits, and fuel prices. Fuel efficiency is a significant factor when considering long-term car ownership costs. Cars with high fuel efficiency generally offer more savings on fuel, particularly for drivers who cover long distances regularly.

Gasoline-powered vehicles, hybrid cars, and electric vehicles each have distinct fuel costs. Electric cars typically cost less per mile but may require charging infrastructure, while gasoline prices can fluctuate significantly. Choosing a car with optimal fuel efficiency can save money, especially over many years of ownership. For older vehicles with diminishing fuel efficiency, contacting a “car wrecker Adelaide” can be a worthwhile option to explore for selling the vehicle for parts.

Maintenance and Repairs: Regular and Unexpected Costs

Maintenance and repairs can vary significantly depending on the vehicle’s age, make, and model. Newer vehicles generally have lower maintenance costs, with manufacturers offering warranties that cover major repairs for a few years. However, as cars age, they require more frequent maintenance, such as oil changes, brake replacements, and tire rotations.

Unexpected repairs, such as replacing a transmission or dealing with engine issues, can be costly and should be factored into the total cost of ownership. Having an emergency fund or including repair costs in your budget is essential. When maintenance becomes more costly than the car’s value, selling to a “car wrecker Adelaide” can help recover some of these expenses.

Registration, Taxes, and Fees

Every vehicle owner is responsible for paying registration fees, taxes, and other associated costs, which vary by region. These fees are usually annual expenses and are mandatory for legally driving the vehicle. Additionally, some areas have emission and inspection fees, which ensure that vehicles meet safety and environmental standards.

For a more accurate understanding of car ownership costs, it’s essential to check local requirements and budget for these recurring fees. While registration costs may seem minor compared to other expenses, they accumulate over the years. In situations where a vehicle fails to meet emission standards or is no longer roadworthy, owners may consider a “car wrecker Adelaide” for disposal.

Parking and Storage Costs

Depending on where you live, parking can either be a non-issue or a significant monthly expense. Urban dwellers may face high parking fees, either for renting a dedicated parking spot or for street parking. Storage costs are another factor for owners who don’t drive their vehicle regularly but want to keep it in good condition.

In some areas, public parking fees are an additional burden, especially for commuters. Ensuring you have a reliable and affordable parking solution can make a big difference in car ownership costs. If parking costs or vehicle storage become prohibitive, seeking options to sell the vehicle through a “car wrecker Adelaide” can alleviate some financial strain.

Alternative Options and End-of-Life Costs

Once your vehicle has served its purpose, there are disposal costs to consider. Many car owners may be unaware of end-of-life options that can help offset costs. For instance, selling to a car wrecking service is a popular option for older cars no longer in optimal condition.

A “unwanted car removal in Adelaide” can assist in recycling vehicle parts and materials, offering car owners a way to make some money off parts that would otherwise go unused. This option is environmentally friendly, as it promotes the reuse of parts, and can be financially rewarding for car owners who no longer need their vehicle.

Making an Informed Decision

Understanding the true cost of car ownership helps in making more informed purchasing decisions. While the sticker price is an essential factor, recognizing and planning for all associated costs can significantly reduce financial stress. This comprehensive approach includes financing terms, depreciation, maintenance, and fuel efficiency, among others.

Ultimately, ownership costs vary widely based on individual circumstances, vehicle type, and location. Being aware of options like “car wrecker Adelaide” can also be beneficial, especially when the time comes to retire or sell your vehicle. By carefully evaluating these costs, you can better understand the financial commitment involved in car ownership and select a vehicle that aligns with your budget and lifestyle.

In conclusion, the true cost of owning a car goes well beyond the sticker price. Factoring in everything from financing fees to potential resale options ensures that car owners are better prepared financially throughout the lifespan of their vehicle. Whether you’re choosing a new car or weighing the options for your current one, understanding the total cost of ownership is the key to a sound investment.