Managing finances efficiently is crucial for businesses of all sizes. From tracking expenses to generating financial reports, having the right tools can make all the difference. That’s where online accounting software comes into play. In this guide, we’ll explore what makes online accounting software indispensable, how to choose the best one for your needs, and why it’s a game-changer for modern businesses.

What is Online Accounting Software?

Online accounting software refers to cloud-based tools that help businesses manage their financial transactions and records. Unlike traditional accounting systems, these solutions are hosted online, allowing users to access them from anywhere with an internet connection. This convenience makes them ideal for startups, small businesses, and large corporations alike.

Why is Online Accounting Software Important for Businesses?

In today’s fast-paced world, staying on top of your finances is non-negotiable. Here’s why online accounting software has become a cornerstone of successful financial management:

1. Real-Time Access

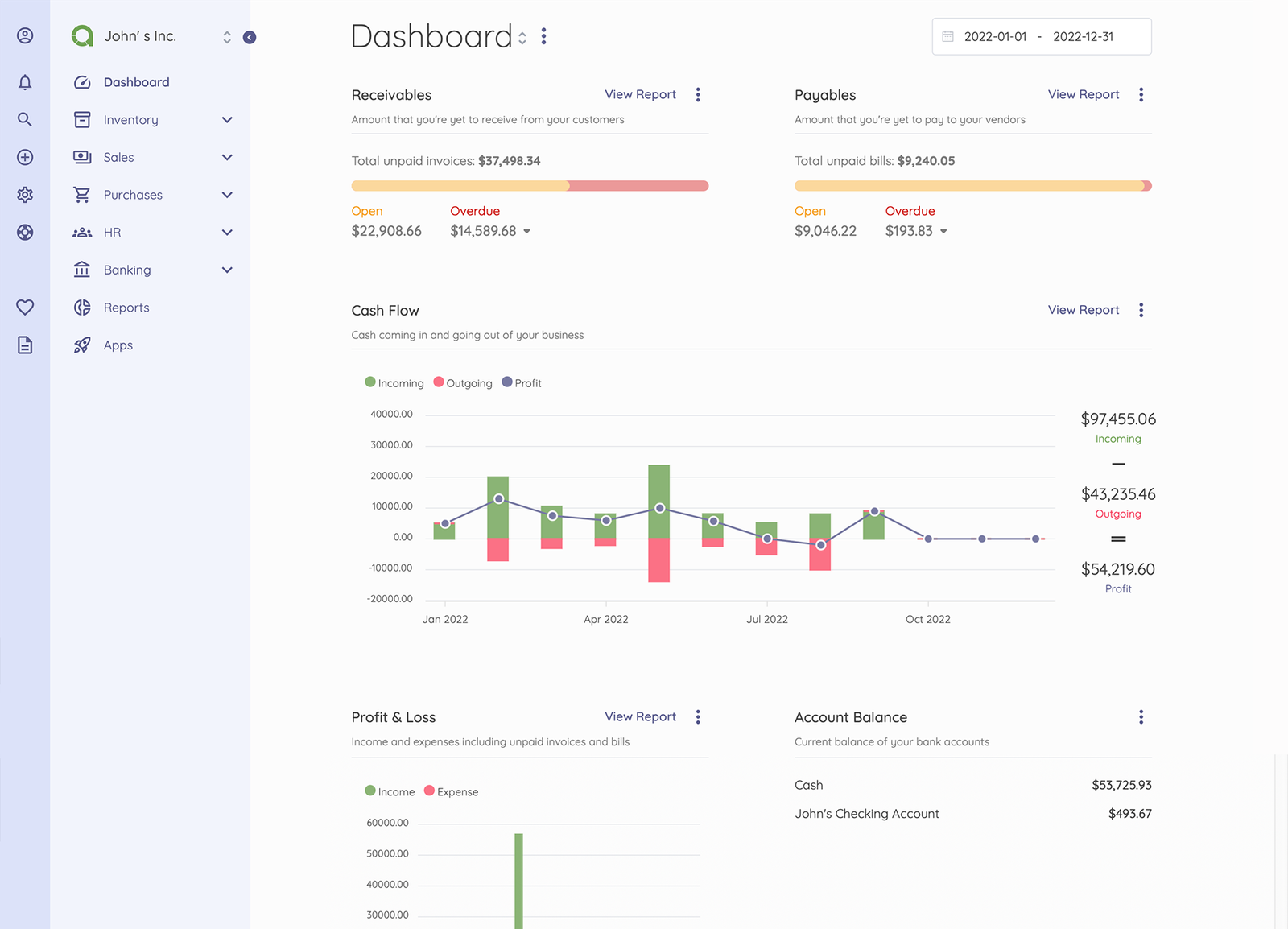

Imagine having your entire financial dashboard at your fingertips, no matter where you are. Online accounting software offers real-time access to data, making it easier to monitor cash flow, track expenses, and make informed decisions.

2. Cost-Effective Solution

Gone are the days of expensive software installations. Most online accounting software operates on a subscription model, allowing businesses to pay only for the features they need.

3. Automation Saves Time

From automatic invoice generation to tax calculations, these tools automate tedious tasks, saving valuable time and reducing human error.

4. Scalability

As your business grows, so do your financial needs. Online accounting software can scale with your operations, offering advanced features like inventory management, payroll integration, and multi-currency support.

5. Data Security

Reputable providers ensure that your financial data is encrypted and stored securely in the cloud, protecting it from unauthorized access and data breaches.

Features to Look for in Online Accounting Software

Not all accounting software is created equal. Here are some must-have features to consider:

1. User-Friendly Interface

The software should be intuitive and easy to navigate, even for those without an accounting background.

2. Customizable Invoicing

Look for tools that let you create professional invoices tailored to your brand.

3. Expense Tracking

A robust expense tracking feature helps you categorize and monitor your spending patterns effectively.

4. Reporting and Analytics

Comprehensive reporting tools allow you to analyze your financial health and make data-driven decisions.

5. Integration Capabilities

Choose software that integrates seamlessly with other tools you use, such as CRM systems or e-commerce platforms.

6. Mobile Accessibility

Mobile apps for online accounting software let you manage your finances on the go.

Popular Online Accounting Software Options

Here’s a rundown of some top-performing online accounting software in the market:

1. QuickBooks Online

Known for its versatility, QuickBooks offers features like invoicing, expense tracking, and payroll management. It’s a great option for small to medium-sized businesses.

2. Xero

Xero is celebrated for its user-friendly interface and robust features like multi-currency accounting and inventory management.

3. FreshBooks

FreshBooks excels in invoicing and time-tracking, making it a favorite among freelancers and service-based businesses.

4. Wave

Wave is a free option that provides essential accounting tools for small businesses, including invoicing and receipt scanning.

5. Zoho Books

Zoho Books integrates seamlessly with other Zoho products and offers advanced features like project management and inventory tracking.

How Online Accounting Software Helps Adventure Capitalists

For adventure capitalists who juggle multiple investments and ventures, online accounting software is a lifesaver. Here’s how:

1. Tracking Multiple Accounts

Adventure capitalists often manage funds across various accounts. With online accounting software, consolidating these accounts becomes effortless.

2. Analyzing ROI

Investing is all about returns. Accounting software provides detailed reports to analyze the performance of each investment.

3. Budgeting for New Ventures

With advanced forecasting tools, adventure capitalists can allocate resources wisely and budget for future projects.

4. Streamlined Tax Management

Tax season can be daunting, especially when dealing with complex portfolios. Online accounting software simplifies tax filing by organizing all necessary data in one place.

Tips for Choosing the Right Online Accounting Software

Finding the perfect software for your needs can feel overwhelming. Here are some tips to guide your decision:

1. Assess Your Business Needs

Understand your requirements, such as the number of users, transaction volume, and specific features you need.

2. Consider Your Budget

While free options exist, investing in a premium solution might be worthwhile for advanced features and better support.

3. Read Reviews and Testimonials

Learn from other users’ experiences to gauge the software’s reliability and performance.

4. Take Advantage of Free Trials

Many providers offer free trials. Use this opportunity to test the software before committing.

5. Prioritize Customer Support

Reliable customer support can save you a lot of headaches in the long run.

Final Thoughts: Transform Your Finances with Online Accounting Software

Incorporating online accounting software into your business strategy can revolutionize how you handle finances. Whether you’re a small business owner, freelancer, or adventure capitalist, these tools offer the flexibility, automation, and insights you need to thrive in today’s competitive landscape.

By choosing the right software, you’ll not only streamline your financial operations but also unlock new opportunities for growth and success. So, take the plunge and empower your business with the best online accounting software today!